multistate tax commission members

The compact is intended to help states administer tax laws that apply to multistate. Sovereignty members are states that support the purposes of the Multistate Tax Compact through regular participation in and financial support for the general activities of the.

Multistate Tax Commission Home

Matthew Barnachia Public member André R.

. Those states are Delaware Nevada and Virginia. The multistate tax commission a multistate agency made up of state taxing authorities whose aim is to encourage uniform state tax laws has adopted after several months consideration a. The Multistate Tax Commission has filed an amicus brief in the case of VAS Holdings and Investments LLC v.

Salaries reviews and more - all posted by employees working at Multistate Tax Commission. T he California Coastal Commission has 12 voting members and 3 non-voting members. She oversees and manages the organization which has expanded since 1981 and now offers a comprehensive range of eldercare services to seniors in the Bay Area.

The Multistate Tax Compact is an interstate compact among 15 states and the District of Columbia. Chung is a Board. Compact members have enacted the commissions Multistate Tax Compact into their state law sovereignty members support the compact through their regular participation in the.

Commissioner of Revenue Massachusetts Supreme Judicial Court No. See what employees say its like to work at Multistate Tax Commission. DOWNLOAD FORM HERE State Tax Audit Defense.

Intergovernmental State Agency Whose Mission Is To Promote Uniform And. Only three states in America are not members of the Multistate Tax Commission. This allows multistate tax payers to properly apportion their tax liabilities in a manner that does not undertake any undue administrative burden.

Examples of Multistate Tax Commission in a sentence. Six of the voting members are public members and six are local elected officials who come from. The multistate tax commission mtc is an interstate instrumentality located in the united states.

The Multistate Tax Commission not more than once in five years may adjust the 100000 figure in order to reflect such changes.

Uniformity Committee Memo Multistate Tax Commission

Forty Two States Have Now Adopted Marketplace Sales Tax Collection Laws Multistate

Cost Council On State Taxation

Amendment To Model Regulation Iv 17 Multistate Tax Commission

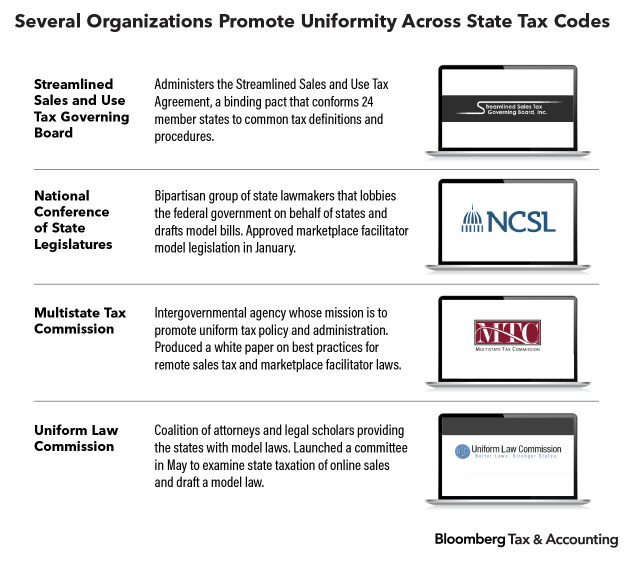

Online Sellers Lament Lack Of State Sales Tax Uniformity

Nelson Mullins North Carolina Conforms Definition Of Apportionable Income To Multistate Tax Commission Uditpa Model

The Multistate Tax Commission The Most Influential State Tax Policymaker You May Have Never Heard Of Andersen

Multistate Tax Commission Home

Multistate Tax Commission Home

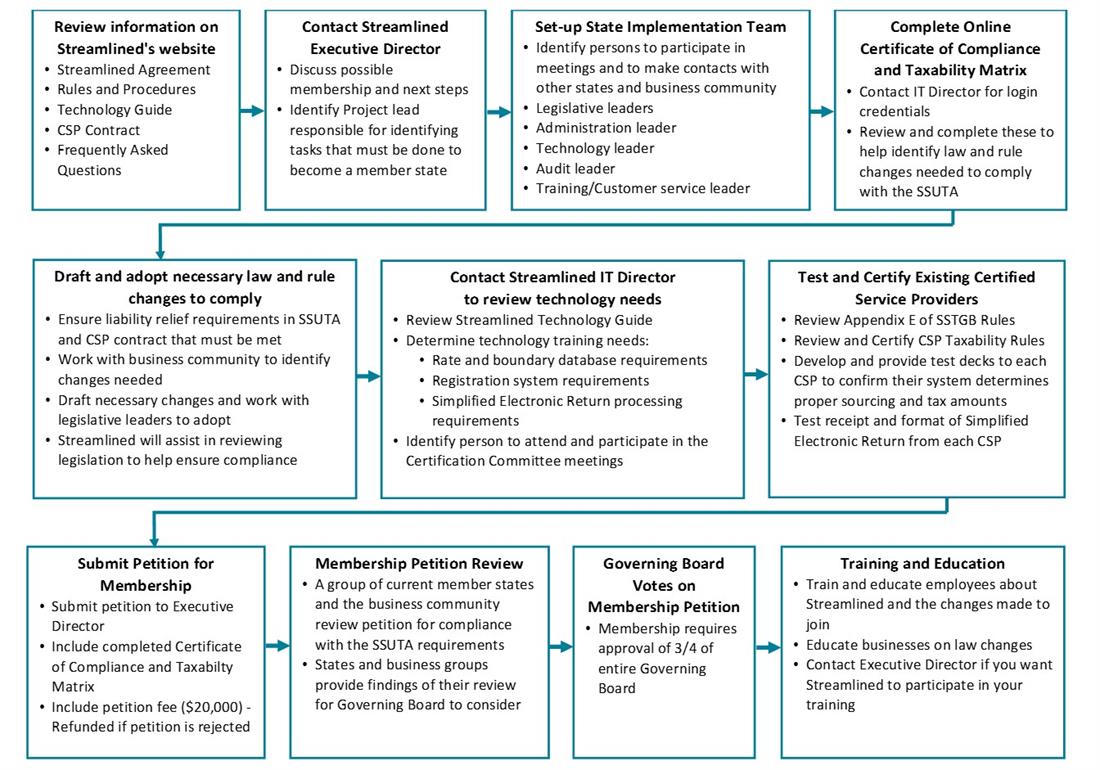

State Membership Process Chart

Multistate Tax Commission Reviews Draft Design For Transfer Pricing Project Deloitte Us

Multistate Tax Commission Home

The Willis Commission Report The Most Important Tax Study That You Probably Haven T Read Tax Foundation

Understanding Pl 86 272 And What It Means To Your Clients

Multistate Tax Commission Home

Implementing Recent Mtc Guidelines Pl 86 272 And The Finnigan Method Cpe Taxops